Signature Collection

Explore SignatureProperties for rent in Dubai

610 listings

Sort:

Mortgage Calculator

Calculate your monthly mortgage repayments

Total Price (AED)

Down Payment (%)

Interest Rate (%)

Loan Period Yearly

Monthly Payments

AED 0 /month

Properties for Rent in Dubai

Dubai is a city epitomizing modern luxury, offering a vibrant collection of high-end residences tailored to those seeking an exceptional lifestyle. From sleek apartments in futuristic skyscrapers to palatial villas with private waterfronts, the selection of properties for rent in Dubai is as diverse as it is luxurious. With a focus on unparalleled comfort and world-class amenities, Dubai’s rental properties set the standard for elegance and sophistication, catering to residents who desire more than just a place to live—they seek a lifestyle experience.

What makes Dubai properties for rent truly unique is the blend of cutting-edge design and cultural richness. Each property is crafted to reflect the city's global reputation for innovation, offering spaces that seamlessly integrate modern living with artistic flair. These properties often feature panoramic views of iconic landmarks, such as the Burj Khalifa or the Arabian Gulf, alongside thoughtful amenities like infinity pools, spa facilities, and bespoke concierge services. Dubai’s rental offerings are designed to complement its cosmopolitan charm and provide an oasis of luxury in the heart of a bustling metropolis.

Whether you're a professional relocating to the city, an expatriate seeking comfort, or a family in pursuit of a lavish lifestyle, Dubai’s rental market delivers unmatched options. The city’s reputation as a global hub ensures that properties for rent in Dubai cater to every taste, from minimalist modern apartments to expansive homes in tranquil neighborhoods. Each residence is a testament to Dubai’s commitment to quality, offering not just a home but a refined living experience that resonates with luxury at every level.

Why Should You Consider Properties for Rent in Dubai?

Dubai offers an unmatched lifestyle, making it one of the most sought-after destinations for luxury living. Opting for a property for rent in Dubai allows you to experience the city's vibrant culture, world-class infrastructure, and iconic landmarks without the long-term commitment of ownership. With options ranging from stylish apartments to spacious villas, renting provides flexibility and access to some of the finest amenities, such as private pools, gyms, and concierge services. Whether you're looking to rent property in Dubai for professional purposes or to enjoy a luxurious lifestyle, the city’s rental market ensures something for everyone.

Additionally, Dubai’s rental process is straightforward, making it an ideal choice for expatriates and families seeking a hassle-free transition. Choosing to rent a house in Dubai gives you the freedom to explore prime locations like Downtown Dubai, Palm Jumeirah, or Dubai Marina while enjoying the benefits of living in a global hub. With properties designed to suit various budgets and preferences, renting in Dubai combines flexibility with the allure of high-end living, offering you the perfect opportunity to experience the city in style.

Types of Properties for Rent in Dubai

Dubai's rental market is as diverse as the city itself, offering an array of options tailored to every lifestyle and preference. From elegant apartments to grand villas, properties for rent in Dubai provide access to world-class amenities and premium locations. Whether you're seeking a modern city dwelling, a spacious family retreat, or a business space to enhance your professional presence, the options for real estate Dubai rent are designed to meet your needs.

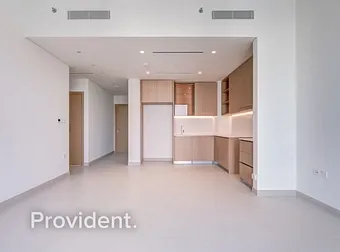

Apartments

Apartments are among the most popular choices when it comes to Dubai properties for rent, offering a blend of luxury and convenience. These properties range from studio apartments to expansive penthouses, often located in high-rise buildings with panoramic views of the skyline. Choosing an apartment allows residents to enjoy amenities like swimming pools, gyms, and concierge services while being close to shopping, dining, and entertainment hubs. For those seeking an apartment for rent in Dubai, it provides an ideal living solution.

Ideal for professionals and small families, apartments provide a modern and accessible way to rent property in Dubai in prime locations like Downtown Dubai, Dubai Marina, and Business Bay.

Villas

For those seeking space, privacy, and an exclusive lifestyle, villas are the ultimate choice. A rental house in Dubai often comes in the form of luxurious villas situated in tranquil neighborhoods such as Emirates Hills, Palm Jumeirah, and Arabian Ranches.

These properties offer expansive layouts, private gardens, swimming pools, and even beach access in some cases. Renting a villa is perfect for families or individuals looking to enjoy the luxury and serenity that Dubai’s residential communities provide, along with access to high-end amenities and services.

Townhouses

Townhouses strike the perfect balance between the spaciousness of villas and the convenience of apartments. These Dubai properties for rent are popular among families seeking a community-focused lifestyle. For those looking for townhouses for rent in Dubai, it offers a harmonious blend of privacy and community living.

Located in areas like Jumeirah Village Circle and Dubai Hills Estate, townhouses offer modern designs, outdoor spaces, and access to communal facilities like parks and swimming pools. Renting a townhouse provides an opportunity to enjoy the best of both worlds—a private residence with a strong sense of neighborhood.

Penthouses

Penthouses represent the pinnacle of luxury living in Dubai. These exclusive properties to rent in Dubai offer unparalleled views, expansive interiors, and bespoke features such as private pools, terraces, and dedicated elevators.

Penthouses are found in prestigious locations like Palm Jumeirah and Downtown Dubai. They are ideal for those seeking a refined lifestyle. Renting a penthouse allows you to experience the height of sophistication and exclusivity in the heart of the city.

Commercial Properties

Dubai is a thriving business hub, and the demand for real estate Dubai rent extends beyond residential options. Commercial properties, including office spaces, warehouses, and industrial units, cater to businesses of all sizes.

Prime areas like DIFC, Business Bay, and Sheikh Zayed Road provide excellent connectivity and infrastructure, making it easy to rent real estate in Dubai for professional use. These properties are designed to support growth and offer premium facilities for modern enterprises.

Retail Spaces

For entrepreneurs and retail businesses, Dubai offers an impressive range of retail spaces for rent. From bustling malls like Dubai Mall and Mall of the Emirates to high-footfall streets, retail spaces are an excellent opportunity to establish or expand your brand. The flexibility of Dubai real estate for rent ensures businesses can find the ideal location to attract customers and thrive in one of the world’s most dynamic markets.

Office Spaces

Dubai’s reputation as a global business hub makes its office spaces some of the most sought-after properties for rent in Dubai. Located in areas such as JLT, DIFC, and Downtown Dubai, these spaces cater to startups, SMEs, and multinational corporations. With options ranging from co-working spaces to fully-furnished offices, renting office space in Dubai offers businesses a prestigious address and access to essential facilities, enhancing their corporate presence in the region.

Best Areas to Rent a Property in Dubai

Dubai offers an impressive selection of neighborhoods tailored to suit a variety of lifestyles, making it an ideal destination to rent a property in Dubai. From vibrant city centers to serene waterfront communities, each area provides unique advantages, ensuring you find the perfect place to call home.

Popular Neighborhoods for Expats

Dubai is a melting pot of cultures, offering a variety of neighborhoods that cater to the diverse needs of its expatriate population. Whether you’re looking for a bustling urban vibe or a tranquil suburban retreat, there’s a perfect place to rent property in Dubai for every lifestyle.

- Properties in Downtown Dubai: Known as the heart of the city, Downtown Dubai features iconic landmarks like the Burj Khalifa and Dubai Mall. This vibrant area offers luxurious properties for rent in Dubai, ideal for professionals seeking upscale living close to business hubs. Its wide range of modern apartments ensures you can find the perfect property to rent in Dubai that combines style and convenience.

- Properties in Dubai Marina: Renowned for its modern high-rises and vibrant waterfront living, Dubai Marina offers a variety of Dubai properties for rent, including stylish apartments with stunning marina views. With its dynamic atmosphere and access to leisure activities, it’s a top choice for those looking to rent real estate in Dubai that caters to a cosmopolitan lifestyle.

- Properties in Jumeirah Beach Residence (JBR): JBR is a prime destination for those who wish to rent property in Dubai by the beach. Featuring upscale apartments and direct access to The Walk, JBR offers a unique blend of beachfront living and urban convenience. Its relaxed yet luxurious vibe makes it a standout choice among Dubai real estate for rent options.

- Properties in Business Bay: It is a thriving business hub, offering sleek apartments perfect for professionals. With plenty of properties for rent in Dubai, Business Bay provides excellent connectivity to Downtown and other key districts. Whether you're seeking a modern apartment or a premium office space, Business Bay is a go-to location for those looking to rent Dubai real estate in a strategic area.

- Properties in Palm Jumeirah: Synonymous with luxury, offering exclusive villas and high-end apartments, Palm Jumeirah is an iconic location ideal for families and individuals seeking a rental house in Dubai or a premium waterfront residence. Its array of world-class amenities and breathtaking views make it one of the most coveted Dubai properties for rent.

Family-Friendly Communities

Dubai is home to some of the most sought-after family-oriented neighborhoods, offering spacious homes, excellent amenities, and a safe environment. These properties for rent in Dubai cater to families seeking a comfortable and community-focused lifestyle, with easy access to schools, parks, and recreational facilities.

- Properties in The Springs: Known for its tranquil lakes and landscaped gardens, The Springs is a gated community ideal for families. It offers a range of properties to rent in Dubai, including spacious villas with private gardens. Residents enjoy access to shared pools, playgrounds, and shopping centers, making it a convenient and safe neighborhood for families.

- Properties in DAMAC Hills 2: Formerly known as Akoya, DAMAC Hills 2 is a vibrant community with a focus on outdoor living. Offering a mix of villas and townhouses, this area is perfect for those wanting to rent property in Dubai that includes family-friendly features like waterparks, sports facilities, and cycling tracks. Its blend of modern living and natural surroundings appeals to families seeking an active lifestyle.

- Properties in Al Furjan: This is a growing residential community that offers spacious villas and townhouses with a strong focus on family living. Its proximity to schools, shopping malls, and metro stations makes it convenient for families seeking real estate Dubai rent options in a connected and well-developed neighborhood. Al Furjan’s community vibe and excellent amenities make it an ideal choice for families.

Waterfront and Golf Communities

The city offers a range of stunning waterfront and golf communities, combining luxury with serene surroundings. These properties for rent in Dubai are perfect for individuals and families seeking picturesque landscapes, world-class amenities, and exclusive lifestyles. Whether you prefer the tranquility of the sea or the lush greenery of a golf course, Dubai's rental market has options to suit every taste.

- Properties in Dubai Creek Harbour: Nestled along the waterfront, Dubai Creek Harbour is an ideal destination for those looking to rent property in Dubai, which has breathtaking views of the creek and skyline. This vibrant community offers modern apartments and townhouses, complemented by world-class dining, shopping, and leisure facilities. It's a perfect blend of nature and urban living among Dubai real estate for rent options.

- Properties in Jumeirah Golf Estates: A haven for golf enthusiasts, Jumeirah Golf Estates features luxurious villas and townhouses set amidst championship golf courses. This community offers a serene environment with access to premium amenities, including fitness centers, pools, and recreational areas. It’s a top choice for families seeking to rent a house in Dubai with a unique lifestyle surrounded by greenery.

- Properties in Bluewaters Island: For waterfront living, Bluewaters Island is a standout among Dubai properties for rent. Offering high-end apartments with panoramic views of the Arabian Gulf and the Ain Dubai Ferris wheel, it provides a mix of luxury and entertainment. Its location near JBR and The Walk ensures residents can enjoy a premium lifestyle in one of Dubai’s most iconic settings.

- Properties in Emirates Hills: Often referred to as Dubai’s Beverly Hills, Emirates Hills is an exclusive gated community offering expansive villas overlooking a championship golf course. Ideal for those looking to rent real estate in Dubai with unmatched privacy and luxury, this community is favored by families and professionals alike. It offers the ultimate combination of space, elegance, and tranquility.

- Properties in The Lagoons: Located near Dubai Creek, The Lagoons is a picturesque community featuring stunning waterfront villas and townhouses. Residents enjoy a peaceful lifestyle with access to lush parks, promenades, and recreational areas. If you’re searching for a property to rent in Dubai with scenic water views and modern conveniences, The Lagoons is an excellent choice for waterfront living.

Short-Term vs Long-Term Rentals in Dubai

Short-term rentals in Dubai are ideal for tourists, business travelers, and residents seeking flexibility. These properties for rent in Dubai often come fully furnished, with utilities and amenities included, making them a hassle-free option for stays ranging from a few days to several months. Located in prime areas like Downtown Dubai, Dubai Marina, and Palm Jumeirah, short-term rentals allow residents to experience the city’s luxury and convenience without long-term commitments.

Long-term rentals, on the other hand, are better suited for families, professionals, and expatriates looking to rent property in Dubai for a year or more. These options typically include apartments, villas, and townhouses in well-established communities. Long-term leases provide stability, better value, and a wider range of choices, from renting real estate in Dubai in suburban neighborhoods like Arabian Ranches to vibrant hubs like Business Bay.

Process to Rent Real Estate in Dubai

Renting real estate in Dubai is a straightforward process designed to cater to residents and expatriates. Start by exploring properties for rent in Dubai through trusted agents or online platforms. Once you find a suitable property for rent in Dubai, arrange a viewing and negotiate the terms with the landlord. Typically, tenants need to provide a valid ID, a residence visa, and an Emirates ID.

After finalizing the agreement, sign the tenancy contract, which is registered with Ejari to ensure compliance with local regulations. Payments usually include rent (often in post-dated checks), a security deposit, and agency fees. Whether you choose to rent property in Dubai short-term or long-term, ensure all terms are clear before signing to enjoy a seamless rental experience.

FAQs

What documents are required to rent a property in Dubai?

To rent a property in Dubai, you typically need a copy of your passport, Emirates ID, residence visa, and in some cases, proof of income or employment.

Can I rent property in Dubai without a residence visa?

Yes, some short-term rental options are available for tourists and visitors without a residence visa. However, long-term rentals usually require a valid residence visa.

What is Ejari, and why is it important?

Ejari is the official tenancy registration system in Dubai, ensuring legal protection for both tenants and landlords. All tenancy contracts must be registered with Ejari to comply with regulations.

What is the typical lease duration for properties in Dubai?

Long-term leases in Dubai are usually for one year, while short-term rentals can range from daily to monthly agreements.

Are utilities included in the rent?

Utilities are usually not included in the rent for long-term leases. For short-term rentals, utilities are often part of the rental package.

How much is the security deposit for renting real estate in Dubai?

The security deposit for properties for rent in Dubai typically ranges from 5% to 10% of the annual rent for unfurnished and furnished properties, respectively.

Popular Searches for Properties for Rent in Dubai

Searches by Communities

- Properties for Rent in Downtown Dubai

- Properties for Rent in Dubai Harbour

- Properties for Rent in Dubai Land

- Properties for Rent in Dubai Marina

- Properties for Rent in Dubai Hills Estate

- Properties for Rent in Mohammed Bin Rashid City

- Properties for Rent in Business Bay

- Properties for Rent in Meydan

- Properties for Rent in Tilal Al Ghaf

- Properties for Rent in Palm Jumeirah

- Properties for Rent in Dubai South

- Properties for Rent in Jumeirah Beach Residence (JBR)

- Properties for Rent in Jumeirah Lake Towers (JLT)

- Properties for Rent in Jumeirah Village Circle (JVC)

- Properties for Rent in Al Barsha

- Properties for Rent in Al Furjan

Popular Bedroom Types for Apartments

- Studio Apartments for Rent in Dubai

- 1-Bedroom Apartments for Rent in Dubai

- 2-bedroom Apartments for Rent in Dubai

- 3-Bedroom Apartments for Rent in Dubai

- 4-Bedroom Apartments for Rent in Dubai

Popular Bedroom Types for Villas

- 3-Bedroom Villas for Rent in Dubai

- 4-Bedroom Villas for Rent in Dubai

- 5-Bedroom Villas for Rent in Dubai

- 6-Bedroom Villas for Rent in Dubai

Popular Bedroom Types for Townhouses

- 2-Bedroom Townhouses for Rent in Dubai

- 3-Bedroom Townhouses for Rent in Dubai

- 4-Bedroom Townhouses for Rent in Dubai

- 5-Bedroom Townhouses for Rent in Dubai

- 6-Bedroom Townhouses for Rent in Dubai

Popular Bedroom Types for Penthouses

Searches by Amenities

- Properties with Shared Gym

- Properties with Outdoor Spaces

- Properties with Children's Play Area

- Properties Near Retail & Dining

- Pet-Friendly Properties

- Properties Near Metro

- Properties with Swimming Pool

- Properties with Security

- Properties with Concierge Service

- Properties with Covered Parking

- Properties with Spa Facilities

- Beachfront Properties

- Properties Near Golf Course

Apartments

Apartments Villas

Villas Townhouses

Townhouses Penthouses

Penthouses Commercial

Commercial See All Properties

See All Properties Commercial

Commercial Property Management

Property Management List Your Property

List Your Property Mortgages

Mortgages Conveyancing

Conveyancing Short Term Rentals

Short Term Rentals Property Snagging

Property Snagging Partner Program

Partner Program Currency Exchange

Currency Exchange PRYPCO

PRYPCO Ethnovate

Ethnovate Plots

Plots